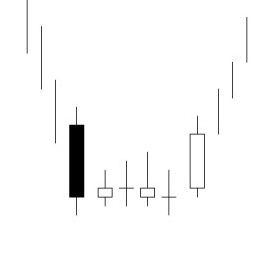

Cradle Pattern Illustration

Cradle Pattern

The Cradle Pattern is a variation of the series of Doji at the bottom. It is aptly named, in that it looks like a ‘cradle’. This makes the Cradle Pattern an easily identified reversal pattern. It begins with the same visual alert found in most candlestick bottoming signals; a large Bearish candle at the bottom of a downtrend. This illustrates the extensive selling at the bottom. The following day shows a candlestick signal such as a Doji, Spinning Top, Harami, Hammer, or Inverted Hammer, indicating that the selling had stopped. Now the candlestick investor should be watching for a Confirmation ‘Buy’ Candlestick Signal. Keep in mind, the small indecisive trading signals may occur for a number of days before the ‘buy’ signal appears.

The Cradle Pattern reveals investor sentiment. If the large dark candle is considered the headboard, the Bullish candle becomes the foot board. The Cradle Pattern formation is now hanging at the bottom, implying that the trend should move up from this level.

The Cradle Pattern was first introduced by Stephen Bigalow in his second book titled

High Profit Candlestick Patterns; Turning Investor Sentiment into High Profits

This Cradle Pattern is also part of our Flash Card Set 2 – High Profit Candlestick Patterns

The clear graphics makes learning these high profit patterns an easy process. Each pattern is fully explained on the backside of the card. The description of how and why the pattern is forming makes understanding the potential of the pattern easy to comprehend. Having this valuable knowledge at your fingertips allows an investor to extract large profits from the markets.

HIGH PROFIT CANDLESTICK PATTERNS

Cradle Pattern

Dumpling Top

Fry Pan Bottom

Jay-Hook Pattern

Scoop Pattern

Trading Channels

Gap Down Hammer at the Bottom

Gap Up Inverted Hammer

Gap Down After a Doji at the Top

Gap Down Doji at the Bottom

Gap Down Bullish Engulfing

Gap Down Bearish Harami

Gap Down Shooting Star

Gap Down Hanging Man

Tweezers Bottom

Tweezers Top

Multiple Tails to the Downside

Series of Shadows at the Top

Series of Doji at the Top

Series of Doji at the Bottom

Doji End of Flat Trading Range Top

Doji End of Flat Trading Range Bottom

Combination Bullish Signals at the Bottom

Combination Sell Signals at the Top

Double Bullish Engulfing Pattern

Double Bearish Engulfing Pattern

Double Bottom

Double Top

Breakout Through Moving Averages

Moving Averages Act as Price Magnets

Moving Average as Support

Moving Average as Resistance

For the Candlestick Forum Original Flash Cards, with the Major Signals, please click here.

Speak Your Mind